Towing Company Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Towing Company Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

towing company Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

TOWING COMPANY FINANCIAL MODEL FOR STARTUP INFO

Highlights

The towing company financial projections spreadsheet serves as a comprehensive 5-year financial planning template tailored for businesses in the towing industry, making it ideal for both startups and established towing services. This template aids in estimating essential towing company startup costs while also providing insights into operational costs for towing services, cash flow projections for towing, and potential revenue streams. By analyzing towing service pricing strategies and evaluating profit margins in the towing industry, users can enhance their towing business profitability. Moreover, it includes tools for towing fleet management, financial forecasting for towing services, and assessing towing business KPIs, ensuring that towing company pricing models align with market demand trends and customer acquisition costs. With a focus on towing contract negotiations and risk assessment, this template becomes a vital resource for devising effective towing business growth strategies.

This towing company financial model Excel template addresses key pain points by providing a comprehensive overview of towing company expenses and potential revenue streams, enhancing overall profitability. The template streamlines operational costs for towing services and supports effective pricing strategies, ensuring that companies can identify optimal towing service pricing models tailored to market demand trends. It offers detailed cash flow projections for towing operations while incorporating risk assessment tools to navigate potential challenges during towing contract negotiations. Furthermore, the model facilitates effective towing fleet management by analyzing towing business KPIs, insurance costs, and customer acquisition expenses, ultimately supporting better financial forecasting and facilitating strategic growth planning.

Description

Our Towing Company Financial Model focuses on providing critical insights for managing operational costs, ensuring profitability, and optimizing revenue streams in the towing industry. Designed to help users conduct a thorough market analysis, this model includes tools for precise financial forecasting, cash flow projections, and risk assessment related to towing service pricing strategies and customer acquisition costs. With features like dynamic assumptions for equipment leasing options, towing contract negotiations, and key performance indicators (KPIs), users can adjust their strategies based on demand trends while evaluating profit margins. Additionally, the model offers a comprehensive breakdown of startup costs, insurance costs, and the financial implications of towing fleet management to aid in achieving sustainable growth in a competitive market.

TOWING COMPANY FINANCIAL MODEL REPORTS

All in One Place

If you're aiming to establish a successful towing company, our innovative financial planning software is tailored for you. It seamlessly integrates operational analysis—covering towing company expenses, revenue streams, and insurance costs—with robust financial forecasting. With editable tables and templates, you can explore vital metrics like profit margins, cash flow projections, and customer acquisition costs. Gain insights into towing service demand trends and improve your towing service pricing strategy. Elevate your business with data-driven decisions, ensuring optimal towing fleet management and sustainable growth. Start building your financial foundation today!

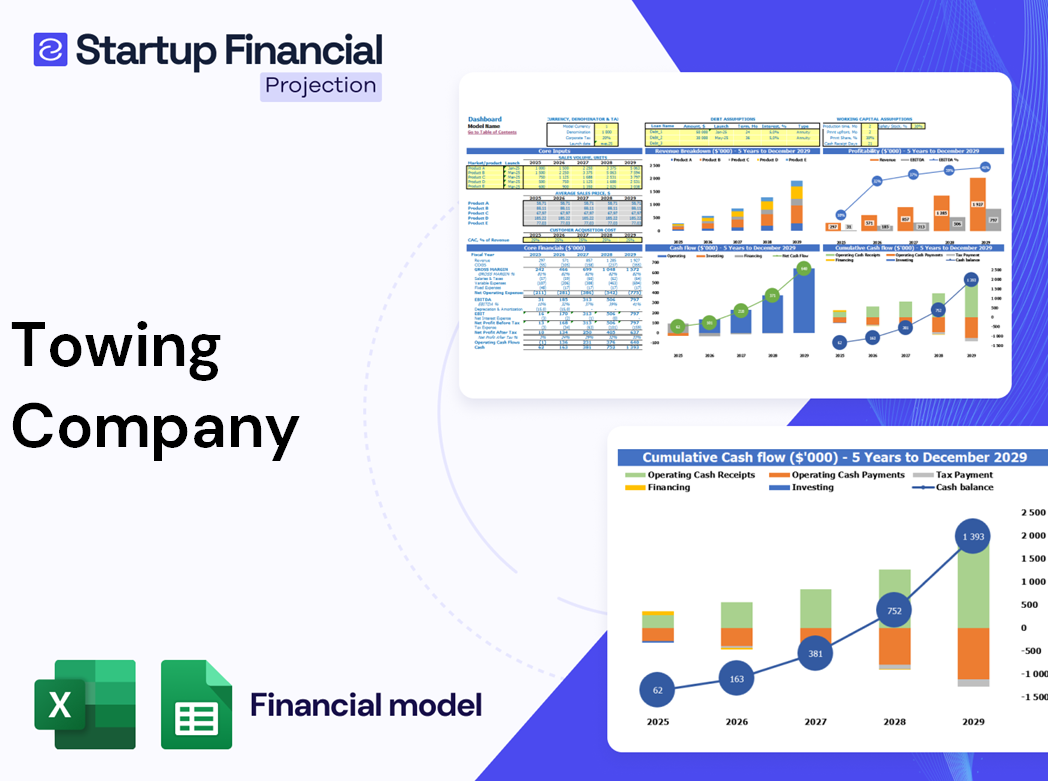

Dashboard

The Dashboard tab in your financial projection startup provides an insightful overview of your towing company’s financial health. With visually engaging graphs, charts, and key ratios, it simplifies the analysis of operational costs, revenue streams, and profitability. Leverage this data to refine your towing service pricing strategy, enhance cash flow projections, and assess business growth strategies. Each summary is designed for easy incorporation into your pitch deck, helping you convey the essential financial insights that drive informed towing contract negotiations and bolster your market position. Elevate your financial storytelling and secure a competitive edge in the towing industry.

Business Financial Statements

Our comprehensive financial modeling tool for towing startups features a pre-built Excel template that streamlines your financial reporting. With automated pro forma income statements, projected balance sheets, and cash flow forecasts, you’ll save time on tedious manual tasks. Generate monthly and annual reports effortlessly. Additionally, users can integrate existing financial statements from popular accounting software like QuickBooks, Xero, and FreshBooks, allowing for seamless rolling forecasts and enhanced consolidation. Optimize your towing business profitability by focusing on key financial metrics while we handle the complexities of financial forecasting.

Sources And Uses Statement

The sources and uses table within the financial model is crucial for towing companies, illustrating how capital is acquired and allocated for essential expenses. This chart identifies primary funding sources and delineates intended expenditures, guiding decision-making and enhancing transparency for stakeholders. For startups in the towing industry, understanding these financial dynamics is vital for assessing operational costs, optimizing cash flow projections, and developing effective towing service pricing strategies. Ultimately, this analysis fosters informed towing business growth strategies, ensuring profitability while navigating market demand trends and risk assessments.

Break Even Point In Sales Dollars

A breakeven analysis is essential for towing companies to determine when they can cover all expenses and start generating profit. To conduct this analysis, first identify fixed costs—such as rent and administrative salaries—which remain constant regardless of sales volume. Next, consider variable costs that fluctuate with service demand, like fuel and equipment maintenance. Understanding both cost categories helps establish pricing strategies and enhances financial forecasting, ultimately contributing to improved profitability and cash flow projections. This analysis is a valuable tool in steering your towing business toward sustainable growth and success.

Top Revenue

In the towing industry, monitoring both top and bottom lines is crucial for assessing profitability. The top line reflects gross sales, indicating a company's revenue streams. "Top-line growth" signifies an increase in these revenues, which can enhance financial health and operational capabilities. Understanding towing service pricing strategies, managing operational costs, and assessing cash flow projections are essential for sustaining growth. By analyzing market trends and optimizing towing fleet management, businesses can improve profit margins and effectively navigate the competitive landscape, ensuring long-term success in this dynamic industry.

Business Top Expenses Spreadsheet

Efficiently monitor your towing company expenses using our comprehensive financial model. The Top Expenses section categorizes costs into four core areas, ensuring a clear overview of operational costs for towing services. Additionally, an 'Other' bucket allows for customization, enabling you to track any unique expenses. This tailored expense report meets the diverse needs of your towing business, supporting effective financial forecasting and cash flow projections. With insights into towing business profitability and risk assessment, you can optimize your pricing strategy and enhance overall operational efficiency.

TOWING COMPANY FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive pro forma template enhances your towing business’s financial planning with an intuitive user interface. Effortlessly update all cells using automated formulas, eliminating the need for manual adjustments. This tool provides accurate cash flow projections, enabling you to analyze towing company expenses and operational costs effectively. With this streamlined financial projections template, you can confidently assess profitability, explore diverse revenue streams, and develop a robust towing service pricing strategy, ensuring you are well-prepared for contract negotiations and market demands. Drive growth and optimize your towing fleet management with ease.

CAPEX Spending

Capital expenditure (CapEx) is crucial for towing company financial forecasting, especially within a three-year projection. Initial startup costs encompass funds needed to acquire and maintain essential assets like towing vehicles and equipment. Effective CapEx planning helps assess operational costs, including depreciation and cash flow projections. Moreover, understanding equipment leasing options can optimize financial performance. By evaluating these metrics, towing businesses can develop robust pricing strategies and identify revenue streams, enhancing profitability and ensuring sustainable growth in a competitive market.

Loan Financing Calculator

Accurately calculating loan payments is crucial for towing company startups to ensure financial stability. Many entrepreneurs find this process challenging, but using our comprehensive business projection template can simplify it. Featuring a loan amortization schedule and integrated calculator, this tool aids in forecasting cash flow projections and managing operational costs for towing services. By effectively planning loan payments, you can optimize towing business profitability and support growth strategies, enabling your company to thrive in a competitive landscape.

TOWING COMPANY EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBIT (Earnings Before Interest and Taxes) is a crucial financial metric in our Excel financial model template. It measures the profitability of your towing business by subtracting towing company expenses, including operational costs and insurance, from your revenue streams. Understanding EBIT allows for informed decisions regarding towing service pricing strategies and aids in cash flow projections. This metric plays a vital role in financial forecasting for towing services, helping to assess profit margins and formulate effective growth strategies. Leverage EBIT to enhance your towing company’s financial health and market position.

Cash Flow Forecast Excel

Creating a comprehensive cash flow projections template is crucial for any towing company startup's financial plan. This model monitors cash movement, detailing inflows and outflows, including payments, receipts, taxes, and net balances. A well-structured spreadsheet offers insights into operational costs, enabling towing businesses to evaluate revenue streams and profitability. It supports financial forecasting and helps assess cash flow for better decision-making, ultimately guiding towing service pricing strategies and contract negotiations. Utilizing effective cash flow management can significantly enhance profit margins and provide clarity in towing business growth strategies.

KPI Benchmarks

The five-year forecast template’s benchmark tab evaluates key performance indicators (KPIs) essential for towing business profitability. By integrating industry-wide averages, it enables a comprehensive benchmarking analysis that highlights operational and financial performance. Leveraging these metrics, towing companies can assess their pricing strategies, operational costs, and revenue streams. This analysis serves as a strategic management tool, guiding startups in the towing sector to align with best practices and optimize cash flow projections, ensuring sustainable growth and effective towing fleet management.

P&L Statement Excel

A monthly profit and loss forecast is essential for towing companies, offering key insights into operational costs and revenue streams. Accurate calculations enrich your financial analysis, enabling effective cash flow projections and identifying profit margins in the towing industry. Utilizing a profit and loss forecast template not only aids in creating annual reports but also supports informed decision-making in towing service pricing strategies and contract negotiations. By diligently assessing financial performance, towing businesses can enhance profitability and explore growth strategies to meet evolving service demand trends.

Pro Forma Balance Sheet Template Excel

A projected balance sheet is essential for your towing company, detailing key assets like equipment and facilities alongside liabilities and capital on a specific date. This financial statement is crucial for demonstrating your company's value to banks, as it highlights loan security through its asset composition. For effective financial forecasting, ensure you incorporate operational costs, revenue streams, and profit margins to showcase your towing business's profitability. A thorough analysis will not only aid in contract negotiations but also enhance your cash flow projections and overall growth strategies in the competitive towing industry.

TOWING COMPANY FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our towing company financial projection template incorporates two essential valuation methods: discounted cash flow (DCF) and weighted average cost of capital (WACC). These analytical tools provide a comprehensive view of your towing business's potential revenue streams and profitability. By integrating these calculations, you can make informed decisions on towing service pricing strategy, assess operational costs, and evaluate cash flow projections. This framework ensures a robust financial foundation, enhancing your towing company’s growth strategies and positioning in the competitive industry landscape.

Cap Table

In the five-year financial projection, a cap table serves as a crucial tool for towing companies. It details securities such as common stock, preferred stock, and options, along with ownership stakes. Maintaining an organized cap table is essential for effective fundraising, strategic towing contract negotiations, and informed decisions on equipment leasing options. Additionally, it aids in assessing towing business profitability and operational costs for towing services. By leveraging this information, towing companies can enhance cash flow projections and align their growth strategies with industry demand trends, ultimately improving profit margins and customer acquisition efforts.

GROCERY STORE BUSINESS PLAN FORECAST TEMPLATE KEY FEATURES

Implementing a robust financial model enhances stakeholder trust by clarifying towing company profitability and informed decision-making strategies.

A robust cash flow model fosters investor confidence, enhancing funding opportunities and guiding strategic growth in the towing business.

A robust financial model for a towing company enhances profitability by accurately forecasting revenue, managing costs, and optimizing pricing strategies.

Streamlining financial forecasting for towing services enhances cash flow projections, attracting investors and boosting overall business profitability.

A robust financial model helps towing companies optimize profitability by effectively managing surplus cash and reducing operational costs.

Effective financial forecasting for towing services empowers managers to strategically reinvest cash surpluses and enhance business profitability.

A robust financial model empowers towing companies to optimize pricing strategies and enhance profitability while minimizing cash flow shortfalls.

Implementing a robust cash flow forecasting model ensures your towing business can adapt to market fluctuations and optimize profitability.

Implementing a comprehensive financial model enhances towing business profitability by effectively managing expenses and optimizing revenue streams.

A well-structured financial model enhances profitability by optimizing towing service pricing strategies and accurately forecasting operational costs.

GROCERY STORE FINANCIAL MODEL ADVANTAGES

A robust financial model helps towing businesses assess profitability and optimize revenue streams for sustainable growth and success.

Utilizing a five-year financial projection template enhances towing business profitability through precise forecasting of revenue streams and operational costs.

Utilizing a comprehensive financial model empowers towing companies to enhance profitability through informed pricing strategies and optimized operational costs.

Pro forma financial statements provide lenders with clear assurance of your towing business's ability to repay on time.

Effective financial forecasting for towing services enhances cash flow management, ensuring profitability and sustainable growth for your business.