Tech Company Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Tech Company Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

tech company Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

TECH COMPANY FINANCIAL MODEL FOR STARTUP INFO

Highlights

This five-year financial forecasting framework is tailored for tech startups and entrepreneurs, providing essential tools for fundraising and strategic business planning. Incorporating a startup valuation model, the template features key performance indicators that analyze tech industry revenue streams, offering in-depth market analysis tools and cost structure analysis. Users can leverage investment return metrics alongside profit and loss projections to evaluate operational efficiency metrics and conduct thorough risk assessment strategies. Additionally, the template includes breakeven analysis, cash flow management, and capital expenditure budgeting, all designed for accurate enterprise value estimation and growth rate projections. Enhance your financial modeling with this comprehensive tool that also allows for scenario planning techniques to optimize your customer acquisition cost and make informed financial decisions.

The ready-made financial model in Excel addresses key pain points by providing a comprehensive financial forecasting framework that simplifies startup valuation and aids in understanding tech industry revenue streams through detailed cost structure analysis. It incorporates essential market analysis tools to enhance investment return metrics, enabling users to make informed decisions based on profit and loss projections and cash flow management. With built-in operational efficiency metrics and risk assessment strategies, this model offers valuable insights into breakeven analysis and customer acquisition costs, while scenario planning techniques allow users to evaluate different growth rate projections. Additionally, financial modeling software capabilities facilitate financial statement analysis and enterprise value estimation, supported by valuation multiples for a practical approach to capital expenditure budgeting.

Description

The tech company financial model template is designed to provide a comprehensive financial forecasting framework that enables informed decision-making through accurate reporting and financial analysis. This model includes essential components such as a startup valuation model, cost structure analysis, and key performance indicators that facilitate a thorough market analysis. By integrating tools for profit and loss projection, cash flow management, and operational efficiency metrics, the model ensures effective capital expenditure budgeting and risk assessment strategies. Additionally, it features scenario planning techniques and investment return metrics, including enterprise value estimation and valuation multiples, to support strategic planning and growth rate projections, ultimately assisting in optimizing customer acquisition cost and achieving breakeven analysis.

TECH COMPANY FINANCIAL MODEL REPORTS

All in One Place

Discover a versatile financial forecasting framework with our customizable Excel model, designed to meet the unique needs of your startup. This powerful financial planning tool facilitates comprehensive cost structure analysis, scenario planning techniques, and market analysis tools to optimize your tech industry revenue streams. With built-in key performance indicators and investment return metrics, it empowers effective profit and loss projections and cash flow management. Enhance your operational efficiency metrics and conduct thorough financial statement analysis with ease, ensuring informed decision-making for sustainable growth and enterprise value estimation. Transform your financial modeling with this essential resource today.

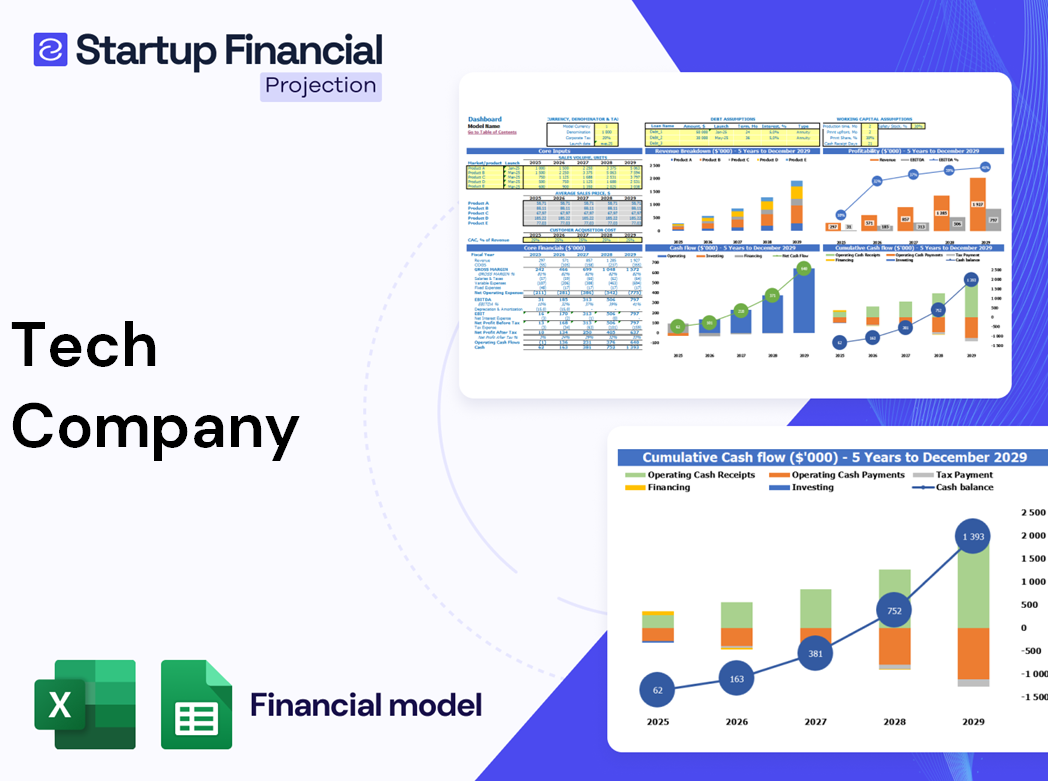

Dashboard

An effective business plan serves as a comprehensive financial forecasting framework that outlines a startup's potential for success. It includes vital elements like cash flow management, profit and loss projections, and cost structure analysis. By utilizing market analysis tools and financial modeling software, businesses can visualize key performance indicators through charts and graphs. This dynamic dashboard, regularly updated with financial data, enhances operational efficiency and supports scenario planning techniques. Ultimately, it acts as a roadmap, ensuring that all aspects of the company remain aligned for sustained growth and investment return metrics.

Business Financial Statements

Our advanced financial forecasting framework streamlines your financial projections effortlessly. With our cutting-edge financial modeling software, simply update your assumptions, and our robust template automatically generates comprehensive financial statements, including profit and loss projections and cash flow management reports. Enhance your startup valuation model while easily incorporating key performance indicators and conducting cost structure analysis. Leverage powerful market analysis tools and scenario planning techniques to inform your strategic decisions. Elevate your operational efficiency metrics and risk assessment strategies, ensuring you are well-prepared for future growth in the tech industry.

Sources And Uses Statement

The sources and uses statement is essential for stakeholders, detailing how a company will finance its projects and allocate capital. This financial forecasting framework ensures that all sources of funds balance with their intended uses. In the Sources section, list funding sources line-by-line, while the Uses section should outline how these funds will be deployed. Ideally, total sources should meet or exceed uses. If sources surpass uses, it indicates excess funds available for growth opportunities. Conversely, if uses exceed sources, additional equity may be necessary, highlighting the importance of effective cash flow management and risk assessment strategies.

Break Even Point In Sales Dollars

Understanding the interplay between fixed and variable costs is crucial for startups, and the breakeven analysis provides valuable insights. By calculating the breakeven point (BEP), businesses can determine when their investment will yield positive returns. Our proforma business plan template visually represents the BEP in sales dollars, offering a mathematical calculation alongside it. This tool also enables users to adjust product pricing, simulating the sales volume needed to achieve breakeven. Incorporating market analysis tools and key performance indicators enhances operational efficiency, guiding startups toward sustainable growth and profitability.

Top Revenue

The top line and bottom line of a company's projected income statement are critical indicators for investors and analysts. The top line represents gross sales, signifying revenue streams vital to a firm’s financial health. When discussing 'top-line growth,' it refers to an increase in revenues, which positively impacts key performance indicators and overall company performance. By leveraging financial forecasting frameworks and market analysis tools, businesses can effectively monitor these metrics, influencing strategic decisions and driving operational efficiency. Understanding this dynamic is essential for startups navigating valuation models and optimizing long-term financial success.

Business Top Expenses Spreadsheet

The "Top Expenses" section of the P&L template in Excel categorizes the company's expenses into four distinct areas. It features a dynamic annual expense chart that highlights essential costs associated with customer acquisition and employee compensation. This comprehensive analysis incorporates both fixed and variable costs, providing a clear overview of the financial landscape. Utilizing this financial forecasting framework enhances operational efficiency metrics, facilitates accurate cost structure analysis, and ultimately supports informed decision-making within the tech industry's diverse revenue streams.

TECH COMPANY FINANCIAL PROJECTION EXPENSES

Costs

Our financial plan serves as a robust financial forecasting framework, essential for effective cost management and operational efficiency. With our startup valuation model and financial modeling software, you can conduct a thorough cost structure analysis and profit and loss projection, ensuring proactive problem-solving. Our business plan Excel template empowers you to leverage key performance indicators and market analysis tools, enhancing transparency for investors. Equip your startup with the tools needed for cash flow management, breakeven analysis, and scenario planning techniques to navigate the tech industry's revenue streams confidently. Make informed decisions and secure your growth trajectory.

CAPEX Spending

Capital expenditures (CapEx) are crucial in financial forecasting frameworks for both startups and expanding companies investing in property, plant, and equipment (PP&E) and innovative technologies. These expenditures represent a significant portion of overall costs, warranting careful attention from financial analysts and investors. Accurately reflecting CapEx in the pro forma balance sheet is essential, though their immediate impact on cash flow management may be limited. By integrating CapEx into financial modeling software, companies can enhance scenario planning techniques and improve operational efficiency metrics, ultimately supporting robust financial projections and growth rate projections.

Loan Financing Calculator

Our robust financial forecasting framework includes a loan amortization schedule template, designed to streamline your financial planning. This model features pre-built formulas that clearly outline the repayment structure, detailing monthly, quarterly, and annual installments, along with corresponding principal and interest amounts. By integrating this tool with key performance indicators and cash flow management strategies, startups can enhance operational efficiency and ensure informed decision-making. Empower your financial strategy with our comprehensive model, facilitating effective scenario planning and optimized investment return metrics for sustainable growth in the tech industry.

TECH COMPANY EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Earnings before interest and taxes (EBIT), often referred to as operational income, serve as a vital profit indicator in startup financial modeling. This metric highlights the disparity between a company's revenue streams and its operational costs, including sales expenses and taxes. Known as operational earnings or operating profit, EBIT effectively showcases a startup’s ability to generate profit. Utilizing financial forecasting frameworks and market analysis tools enhances EBIT assessments, allowing entrepreneurs to refine their financial strategies, optimize cost structures, and drive operational efficiency for sustainable growth.

Cash Flow Forecast Excel

Effective cash flow management is crucial for any startup, underscoring the value of financial forecasting frameworks. Utilizing a pro forma cash flow statement template enables entrepreneurs to visualize inflows and outflows, facilitating strategic insights and innovative ideas. This financial modeling software not only aids in monitoring key performance indicators but also enhances operational efficiency metrics. By incorporating market analysis tools and scenario planning techniques, business owners can optimize capital turnover and revenue streams. Prioritizing robust cash flow strategies is essential for sustainable growth and successful investment return metrics in today’s dynamic tech industry.

KPI Benchmarks

A benchmarking study is essential for enhancing a profit and loss projection within a startup valuation model. By comparing specific key performance indicators—such as unit costs, profit margins, and productivity—against those of industry leaders, businesses can objectively assess their potential. This method not only identifies areas for improvement but also leverages market analysis tools to refine operational efficiency metrics. For startups, benchmarking offers invaluable insights, enabling informed decision-making and strategic planning. Ultimately, it provides a comprehensive view of the company's financial foundation, fostering growth and innovation within the tech industry.

P&L Statement Excel

The projected income statement template enhances financial forecasting by modeling expenses and revenues in real-time. Unlike a monthly cash flow statement that captures actual cash movements, the profit and loss projection incorporates non-cash items, such as depreciation, over several years. This approach is crucial for startups, enabling accurate insights into potential profitability and operational efficiency metrics. By leveraging advanced financial modeling software, businesses can refine their startup valuation model, conduct thorough cost structure analysis, and utilize market analysis tools to optimize investment return metrics and growth rate projections.

Pro Forma Balance Sheet Template Excel

A company's pro forma balance sheet provides a snapshot of total assets, liabilities, and stockholders' equity at a specific moment, illustrating its net worth and capital structure. However, its true value emerges when analyzed alongside the projected income statement, which reveals operational results and financial performance over time. This combination enhances financial forecasting by offering insights into key performance indicators, cash flow management, and investment return metrics. Together, these financial statements serve as vital market analysis tools, supporting effective scenario planning and guiding informed decision-making for operational efficiency and growth.

TECH COMPANY FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This financial model template features a sophisticated startup valuation calculator in Excel, enabling users to effortlessly conduct a Discounted Cash Flow valuation with minimal inputs for the Cost of Capital. By leveraging this tool, entrepreneurs can enhance their financial forecasting framework, perform scenario planning, and assess key performance indicators. The model also facilitates in-depth operational efficiency metrics and cash flow management, aiding in robust investment return metrics and capital expenditure budgeting. It’s an essential resource for navigating the complexities of tech industry revenue streams and optimizing overall financial performance.

Cap Table

This pro forma cap table offers remarkable capabilities, enabling precise calculations of investor share percentages and investment valuations. Its versatility enhances its appeal in financial modeling software, making it an essential tool for startups. By integrating it into your financial forecasting framework, you can streamline cash flow management and fortify your startup valuation model. Utilize this foundational tool to enhance operational efficiency metrics while accurately assessing customer acquisition costs and evaluating investment return metrics. The equity cap table is indispensable for informed decision-making and strategic growth planning in the tech industry.

GROCERY STORE BUSINESS PLAN FORECAST TEMPLATE KEY FEATURES

A robust financial forecasting framework enhances decision-making and maximizes investment returns through effective scenario planning and risk assessment strategies.

Utilize our proven financial modeling software to enhance startup valuation models and optimize investment return metrics without hidden costs.

A robust financial forecasting framework enhances decision-making and optimizes growth with accurate startup valuation models and cash flow management.

Utilizing a tech company financial model template enhances decision-making by clarifying risks and optimizing funding strategies for success.

A robust financial forecasting framework enhances decision-making, saving time and money while optimizing startup valuation models in the tech industry.

Our financial forecasting framework simplifies complex calculations, empowering you to focus on strategy and innovation without costly consultants.

Implementing a robust financial forecasting framework enhances cash flow management and identifies issues with customer payments effectively.

Implementing a cash flow forecasting model enhances operational efficiency by tracking customer payments and minimizing outstanding invoices for improved liquidity.

An integrated financial forecasting framework enhances investor confidence by providing clear insights into growth rate projections and operational efficiency metrics.

The financial projections spreadsheet simplifies complex data into investor-friendly outputs, enhancing decision-making for startups through effective financial modeling.

GROCERY STORE FINANCIAL MODEL ADVANTAGES

Empower your team with a robust financial forecasting framework to optimize tech industry revenue streams and enhance operational efficiency.

A robust financial forecasting framework empowers tech startups to enhance operational efficiency and optimize growth rate projections effectively.

The financial modeling software enables precise tracking of startup costs, ensuring spending aligns with strategic financial forecasting frameworks.

The financial model empowers startups to anticipate cash flows, enhancing operational efficiency and strategic decision-making in the tech industry.

A robust financial forecasting framework empowers startups to make informed decisions and minimize risks in the tech industry's dynamic landscape.