Solar Power Inverter Manufacturing Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Solar Power Inverter Manufacturing Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

solar power inverter manufacturing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

SOLAR POWER INVERTER MANUFACTURING FINANCIAL MODEL FOR STARTUP INFO

Highlights

Creating a robust financial model for solar inverter manufacturing is essential for both startups and established companies aiming to attract investors or secure loans. This model should encompass costs associated with the manufacturing process for solar inverters, including a detailed cost breakdown that highlights capital expenditure and operational cost optimization strategies. Additionally, it must include financial projections for solar inverters, offering insights into profit margins, return on investment, and revenue streams. By conducting a thorough market analysis and forecasting demand for solar inverters, businesses can enhance their financial sustainability and effectively manage supply chain dynamics. A careful break-even analysis will also help identify financial risks and inform strategies for production scalability and efficiency, making the investment analysis for solar inverters a critical component of any comprehensive business plan.

The ready-made financial model in Excel addresses key pain points for buyers by providing an integrated template that simplifies solar inverter manufacturing financial projections, allowing users to efficiently analyze manufacturing costs and break-even points. It includes detailed cash flow sheets that help track investment analysis for solar inverters, ensuring effective operational cost optimization and management of financial risks in the supply chain. With automatic aggregation of annual summaries, users can easily forecast demand and assess profit margins, enhancing their ability to navigate market trends and achieve scalability in production. The model also supports capital expenditure evaluations, enabling users to determine the return on investment for solar inverters while ensuring the financial sustainability of their operations.

Description

The solar power inverter manufacturing financial projection model is highly adaptable, allowing users to incorporate various inputs and assumptions for informed business decisions. This comprehensive Excel model generates detailed 5-year monthly and annual financial projections, including the profit and loss statement, projected balance sheet, and cash flow forecast, tailored for startups or established enterprises. It also features a discounted cash flow valuation based on projected free cash flows and calculates essential financial performance ratios and KPIs necessary for assessing profitability and liquidity, appealing to banks and investors. By providing a clear financial framework, this model aids in operational cost optimization, forecasting demand for solar inverters, and understanding profit margins, ultimately enhancing management efficiency and facilitating effective marketing strategies.

SOLAR POWER INVERTER MANUFACTURING FINANCIAL MODEL REPORTS

All in One Place

Investors demand robust business plans, especially in the solar inverter sector. Our comprehensive financial model template for solar power inverter manufacturing equips startups with essential tools to assess manufacturing costs, project revenue streams, and analyze break-even points. This template provides a detailed cost breakdown and operational cost optimization strategies, ensuring financial sustainability. By forecasting demand and analyzing market trends, you'll present a compelling case to investors, demonstrating potential profit margins and return on investment. With our pro forma financial statements, validate your capital expenditure needs and set your startup on a path to success in the competitive solar inverter market.

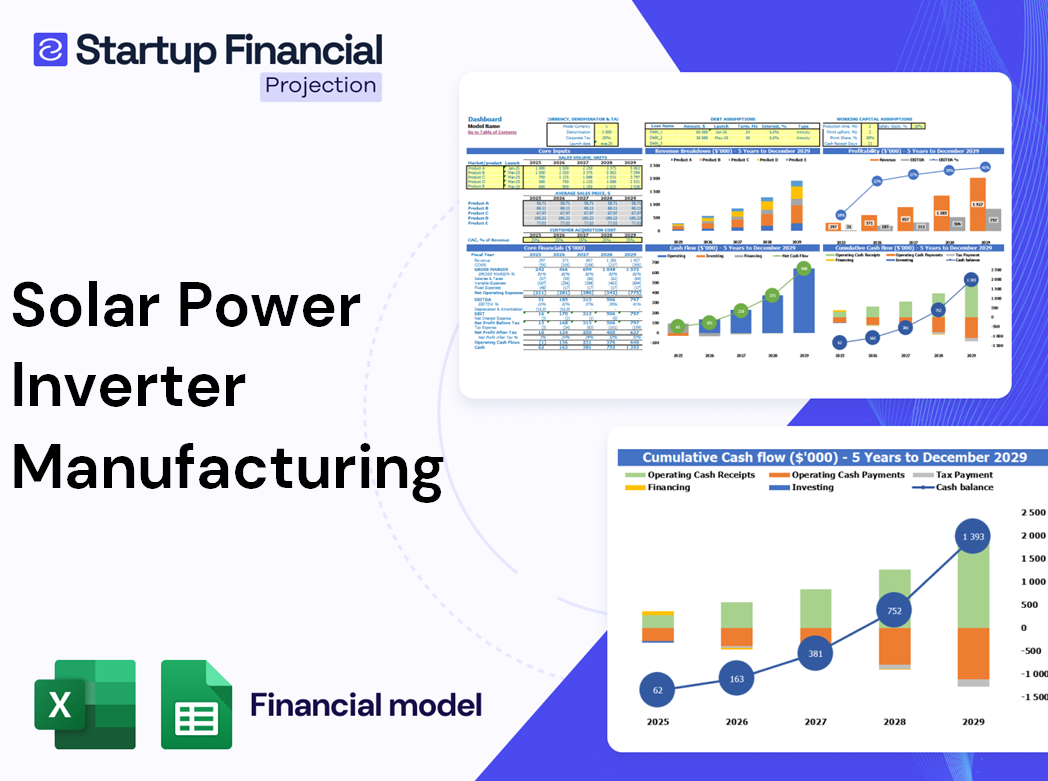

Dashboard

The financial projections dashboard for solar inverter manufacturing provides key insights into operational costs, profit margins, and investment analysis. This dynamic tool allows users to enter data for specific timeframes, facilitating in-depth forecasting and market analysis. By tracking essential financial indicators, it supports effective decision-making and enhances production efficiency. Users can leverage this dashboard to conduct break-even analysis and evaluate return on investment, ensuring the financial sustainability of their solar inverter operations while adapting to market trends and optimizing the supply chain.

Business Financial Statements

In our financial modeling toolkit for startups in the solar inverter sector, you'll find comprehensive Excel templates, including projected profit and loss statements, a five-year balance sheet, and cash flow forecasts. These templates can be tailored for monthly or annual presentations, ensuring clarity in financial projections for solar inverters. Additionally, users can seamlessly integrate detailed financial data from popular accounting software like Quickbooks, Xero, and Freshbooks. This facilitates robust investment analysis, enabling companies to optimize operational costs and enhance production efficiency while navigating the solar power inverter market landscape.

Sources And Uses Statement

In developing a robust financial model for a solar inverter startup, it is crucial to analyze the sources and uses of cash. This encompasses a comprehensive overview of funding avenues and how cash flows through the business. By incorporating elements such as manufacturing costs, operational cost optimization, and break-even analysis, stakeholders can assess profit margins and return on investment. Furthermore, understanding market trends and forecasting demand for solar inverters enhances financial sustainability and mitigates financial risks, paving the way for informed investment analysis and strategic growth in the competitive solar inverter landscape.

Break Even Point In Sales Dollars

A break-even analysis is essential for solar inverter manufacturers seeking financial clarity. This tool identifies the point at which a company or its new product becomes profitable, guiding investment decisions and operational strategies. By calculating the sales volume needed to cover both fixed and variable costs, businesses can optimize their manufacturing process, forecast demand, and enhance production efficiency. This analysis also plays a crucial role in assessing profit margins, ensuring the financial sustainability of solar inverter companies in an evolving market.

Top Revenue

In the solar inverter industry, both topline revenue and bottom-line profitability are critical metrics for evaluating financial health. Investors meticulously track trends in these areas, as rising sales often signal robust market demand and improved operational efficiency. The solar power inverter market analysis reveals that effective cost breakdowns and supply chain management significantly enhance profit margins. Furthermore, financial projections and investment analyses are essential for assessing the long-term sustainability and scalability of solar inverter manufacturing. Understanding these factors enables stakeholders to make informed decisions and optimize capital expenditures for maximum return on investment.

Business Top Expenses Spreadsheet

To optimize manufacturing costs in solar inverter production, it's essential to analyze key expenses continuously. Our financial projection tool provides a comprehensive expense report, highlighting the four largest cost categories along with an 'other' section for easier tracking. This streamlined approach enables companies, both startups and established players, to monitor trends in operational costs effectively. By prioritizing cost management, businesses can enhance profitability and ensure financial sustainability in the competitive solar inverter market. Keeping a close eye on these metrics is crucial for making informed investment decisions and maximizing profit margins.

SOLAR POWER INVERTER MANUFACTURING FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive financial model Excel spreadsheet empowers your solar inverter business to optimize budgeting effectively. With a robust methodology, it forecasts operational and detailed expenses—both recurring and variable—over a 60-month horizon, incorporating precise accounting treatments. The pre-built forecasting curves illustrate how costs evolve, showcasing their relationship to revenues across fixed and variable categories. Additionally, the pro forma template facilitates organized tracking of key expenses, including cost of goods sold (COGS), wages, and capital expenditures (CAPEX), ensuring clarity and accuracy in financial projections for solar inverter manufacturing.

CAPEX Spending

Effective capital expenditure planning is crucial for assessing the financial sustainability of solar inverter manufacturing. By utilizing a detailed feasibility study template, companies can accurately project startup expenses and operational costs over a five-year horizon. These financial projections, presented in an Excel format, support informed decision-making and investment analysis for solar inverters. Comprehensive financial modeling enables businesses to evaluate profit margins, break-even points, and overall production efficiency. Understanding these factors is essential for optimizing the solar inverter supply chain and forecasting demand amidst evolving market trends in solar energy technology.

Loan Financing Calculator

Our financial Excel template features a comprehensive loan amortization schedule, essential for solar inverter companies navigating capital expenditure in solar manufacturing. With pre-built algorithms, it calculates each installment's principal and interest, ensuring clarity in repayment. This tool supports effective financial projections for solar inverters, optimizing operational costs and enhancing cash flow management. By accurately forecasting demand and assessing break-even points, manufacturers can better understand profit margins and revenue streams, making informed decisions that bolster the financial sustainability of their solar energy initiatives.

SOLAR POWER INVERTER MANUFACTURING EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Earnings growth and net earnings are essential metrics in a five-year financial projection plan for solar inverter companies. While earnings growth reflects the progress of a nascent firm, an effective projected income statement template enables continuous monitoring of this growth. Utilizing a comprehensive three-way financial model facilitates analysis of sales and revenue trends, providing insights into the company's trajectory. This approach not only supports operational cost optimization but also aids in forecasting demand and identifying viable revenue streams, ensuring the financial sustainability of solar inverter manufacturers in an evolving market landscape.

Cash Flow Forecast Excel

A robust cash flow analysis is vital for evaluating the financial sustainability of solar inverter companies. The cash flow forecasting model serves as a key component of a comprehensive three-statement financial model. It meticulously reconciles operating, investing, and financing cash flows, ensuring alignment with the pro forma balance sheet. Each cash flow element is integrated across spreadsheets, highlighting critical metrics such as manufacturing costs, profit margins, and investment analysis. Careful cash flow projections enable inverter manufacturers to optimize operational costs, assess financial risks, and make informed decisions to enhance production efficiency and scalability in the growing solar inverter market.

KPI Benchmarks

A five-year cash flow projection template effectively benchmarks key performance indicators against industry averages, offering valuable insights for financial planning in solar inverter manufacturing. By analyzing financial metrics, companies can evaluate their performance against top industry players, identifying best practices essential for operational cost optimization and production efficiency. This comparative analysis aids startups in understanding market trends and financial sustainability, enabling informed investment decisions and risk management. Ultimately, it serves as a critical tool for developing robust financial projections and enhancing profitability in the solar inverter market.

P&L Statement Excel

The monthly profit and loss statement is crucial for solar inverter manufacturers, as it monitors revenues, expenses, and non-cash items like depreciation. While this statement highlights financial performance over time, it complements the cash flow forecast, which focuses solely on actual cash movements. Together, they inform investment analysis and operational cost optimization, enhancing financial sustainability. Understanding profit margins and implementing effective supply chain management can further improve production efficiency and scalability, bolstering overall financial projections in the evolving solar power inverter market. Engaging with these insights will empower manufacturers to navigate market trends and mitigate financial risks effectively.

Pro Forma Balance Sheet Template Excel

Creating a projected balance sheet offers a concise financial snapshot of your solar inverter manufacturing business at a specific date. It encompasses your assets, liabilities, and overall net worth, providing essential insights into operational cost optimization and financial sustainability. Such a balance sheet is crucial for understanding manufacturing efficiency, analyzing profit margins, and assessing capital expenditures. Moreover, it supports investment analysis and forecasting demand for solar inverters, ultimately guiding financial projections and minimizing risks in the evolving solar power market. This strategic tool is vital for informed decision-making and enhancing production scalability.

SOLAR POWER INVERTER MANUFACTURING FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Unlock the potential of your solar inverter business with our comprehensive three-way financial model. Gain insights into manufacturing costs, operational efficiency, and profit margins in solar inverter manufacturing. Our proformas enable precise forecasting demand, break-even analysis, and robust Discounted Cash Flow (DCF) valuation for pre-revenue startups. Elevate your investment analysis, optimize your supply chain management, and ensure financial sustainability in the rapidly evolving solar power inverter market. Make informed decisions today to secure a profitable tomorrow in solar energy technology.

Cap Table

This advanced cap table excels in analyzing financial projections for solar inverters, offering insights into investor share percentages and investment calculations. Its versatility enhances decision-making in the solar power inverter market, enabling manufacturers to optimize operational costs and evaluate profit margins. By streamlining the manufacturing process for solar inverters, this tool aids in break-even analysis and forecasting demand. With a focus on financial sustainability, it empowers solar inverter companies to understand capital expenditure and revenue streams, ensuring efficient supply chain management and improving production scalability. Leverage its capabilities for informed investment analysis and strategic planning in solar energy technology.

GROCERY STORE BUSINESS PLAN FORECAST TEMPLATE KEY FEATURES

Implementing a robust financial model for solar inverters enhances budget tracking and ensures sustainable profit margins amidst market fluctuations.

Utilizing a robust financial model enables precise forecasting of cash flow, ensuring better investment decisions in solar inverter manufacturing.

A robust financial model enhances decision-making by providing clear insights into profit margins and cost optimization in solar inverter manufacturing.

This user-friendly financial model empowers solar inverter manufacturers to achieve reliable projections with minimal Excel expertise, enhancing overall profitability.

A robust financial model for solar inverters enables scenario analysis, enhancing decision-making and optimizing profit margins in manufacturing.

A comprehensive cash flow forecast allows solar inverter manufacturers to visualize financial impacts and optimize operational costs effectively.

A robust financial model identifies cash gaps and surpluses in solar inverter manufacturing, enhancing decision-making and optimizing operational efficiency.

A cash flow forecasting model empowers solar inverter manufacturers to anticipate deficits and seize growth opportunities before they arise.

An effective financial model enhances profit margins by optimizing operational costs and forecasting market trends in solar inverter manufacturing.

Utilize our proven financial modeling tool for solar inverter manufacturing to enhance profitability and streamline cost management effectively.

GROCERY STORE FINANCIAL MODEL ADVANTAGES

The financial projections spreadsheet effectively tracks spending, ensuring optimized operational costs and enhanced profit margins in solar inverter manufacturing.

A robust financial model enhances forecasting demand for solar inverters, optimizing production efficiency and improving profit margins.

The financial model for solar power inverter manufacturing reveals new opportunities for optimizing costs and maximizing profit margins.

Reduce risks and enhance profitability with a robust financial model for solar inverter manufacturing and investment analysis.

A robust financial model enhances decision-making for solar inverter manufacturers, optimizing costs and maximizing profit margins in a competitive market.