Immigrant Legal Advising Firm Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Immigrant Legal Advising Firm Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

immigrant legal advising firm Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

IMMIGRANT LEGAL ADVISING FIRM FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive 5-year business plan template for an immigrant legal services firm includes essential tools such as cash flow proforma, financial forecasting, and a financial dashboard that aligns with GAAP/IFRS formats. By analyzing key metrics like client acquisition costs, attorney fee structures, and legal aid revenue models, the template facilitates strategic budgeting and planning for legal services. It also addresses overhead costs and capital investment needs, providing insights into risk management and client retention strategies to enhance legal practice profitability. Additionally, utilizing immigration case management software can streamline operations, while effective pricing strategies for legal services and revenue generation strategies ensure long-term financial stability for the firm.

This financial model template addresses key pain points for immigrant legal services, providing clarity on immigration consulting financials and simplifying the complexity of budgeting and financial forecasting for law firms. It enables users to effectively manage overhead costs and understand attorney fee structures, offering insights into client acquisition and retention strategies that enhance legal practice profitability. By incorporating legal billing strategies and revenue generation tactics, the template supports risk management while optimizing cash flow management, ultimately leading to informed decision-making and successful financial planning for legal services. With built-in features for analyzing the immigrant legal market, users can confidently project their capital investment and better navigate immigration case management needs.

Description

The immigrant legal advising firm financial model template is a highly adaptable tool designed to facilitate financial forecasting for immigration consulting services, covering essential metrics such as capital investment needs and operational expenses, including overhead costs and client acquisition costs. It allows users to effectively budget and plan for legal services while providing a built-in revenue forecasting mechanism and expense budget to enhance cash flow management and legal practice profitability. With the capability to project financials over a five-year period, this model aids in creating pricing strategies for legal services and informs attorney fee structures, ultimately enhancing risk management and client retention strategies. Additionally, it integrates immigration case management software capabilities to streamline operations and improve financial reporting accuracy, making it a valuable asset for both startups and established firms looking to optimize their revenue generation strategies.

IMMIGRANT LEGAL ADVISING FIRM FINANCIAL MODEL REPORTS

All in One Place

For professionals in immigrant legal services, our three-way financial model template stands out as the optimal choice. Designed to accommodate all financial backgrounds, this user-friendly and expandable tool allows you to customize every sheet and tab. It's perfect for developing comprehensive forecasts and analyses tailored to your immigration law firm's expenses, budget planning, and revenue generation strategies. Enhance your financial planning and improve your client acquisition costs, retention strategies, and overall legal practice profitability with our robust model, ensuring effective cash flow management and strategic pricing for legal services.

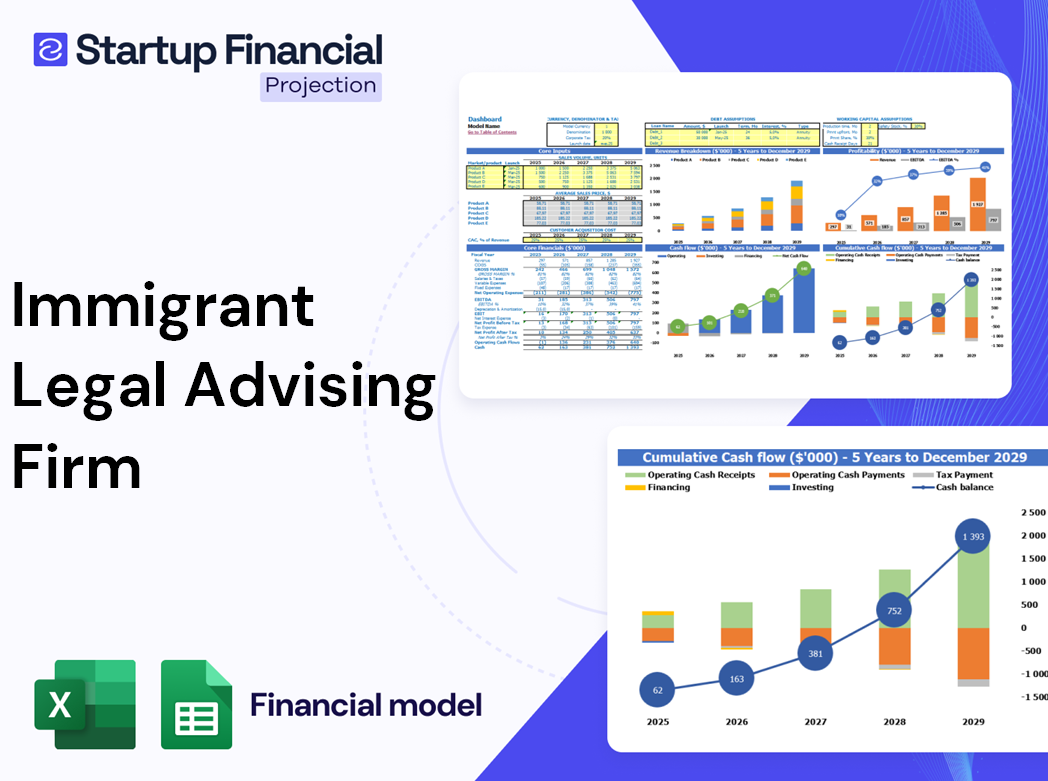

Dashboard

Our financial dashboard template is an essential tool for immigration law firms, offering a clear overview of critical KPIs. It enables effective cash flow management and detailed tracking of expenses, sales, and profits, ensuring alignment with your financial forecasting goals. This intuitive dashboard not only aids in budget planning for legal services but also enhances your ability to implement revenue generation strategies and optimize attorney fee structures. Share insights effortlessly with stakeholders to drive informed decision-making, ultimately boosting legal practice profitability and client retention strategies in the competitive immigrant legal services market.

Business Financial Statements

Our comprehensive five-year financial projection plan equips entrepreneurs with essential Excel reports, calculations, and forecasts. It enhances your immigration consulting financials by facilitating clear communication with investors through detailed reports, charts, and graphs. These visuals effectively summarize financial data, showcasing legal aid revenue models and client acquisition costs. This streamlined approach not only supports financial planning for law firms but also bolsters client retention strategies and revenue generation tactics. Empower your practice with insightful financial forecasting that aligns with pricing strategies and overhead cost management, ultimately driving legal practice profitability.

Sources And Uses Statement

The funds utilization template within our startup financial model provides a comprehensive overview of funding sources and their allocation. This critical blueprint outlines capital investments in the law firm, ensuring effective budgeting and financial planning for legal services. By integrating revenue generation strategies and examining client acquisition costs, our model aims to optimize legal practice profitability. Additionally, it emphasizes cash flow management and risk management, positioning the firm for long-term success in the competitive immigrant legal services market. Through careful analysis, we enhance our pricing strategies and client retention initiatives while streamlining operational expenses.

Break Even Point In Sales Dollars

The break-even point is a crucial financial metric that enables an immigration law firm to assess when it will achieve profitability. By analyzing sales volume against both fixed and variable expenses, firms can strategically plan for revenue generation. This financial forecasting tool is essential for budgeting, capital investment, and managing cash flow. Understanding client acquisition costs and implementing effective client retention strategies can enhance the firm’s profitability. Moreover, leveraging immigration case management software and optimizing attorney fee structures can streamline operations and improve financial planning for legal services, ultimately driving sustainable growth in the immigrant legal market.

Top Revenue

In the realm of immigration law, the top line of your projected income statement—reflecting gross revenues—is crucial for assessing financial health. It signifies your firm's sales growth, a vital indicator for investors and analysts monitoring performance. For immigration law firms, effective financial planning, including budget planning for legal services and understanding overhead costs, drives profitability. Implementing robust client acquisition strategies and legal billing strategies enhances revenue generation. Moreover, precise financial forecasting and cash flow management allow firms to navigate the immigrant legal market effectively, ensuring sustainable growth and client retention in a competitive environment.

Business Top Expenses Spreadsheet

In the Profit Loss Projection, key expenses are categorized to streamline financial analysis for an immigration law firm. This comprehensive financial model encompasses annual client acquisition costs alongside fixed and variable overhead costs. It also accounts for employee salaries, ensuring a clear understanding of legal practice profitability. By implementing robust financial planning strategies, firms can effectively manage cash flow and optimize attorney fee structures, ultimately enhancing revenue generation and client retention. Utilizing immigration case management software further aids in monitoring operational expenses and refining pricing strategies for legal services.

IMMIGRANT LEGAL ADVISING FIRM FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are crucial for any immigration law firm and are a key component of your projected cash flow management. Accurately tracking these expenses from the outset is vital to prevent financial shortfalls. Our financial modeling template offers a specialized proforma to streamline your budget planning and enhance financial forecasting for immigration consulting. By consistently utilizing this tool, law firm owners can effectively monitor overhead costs, improve attorney fee structures, and implement revenue generation strategies to boost profitability and ensure sustainable operations. Invest in financial planning for your legal practice and secure your firm’s future success.

CAPEX Spending

Capital expenditures are essential for the growth and innovation of immigration law firms. By investing in advanced technologies and optimized services, firms can enhance operational efficiency and improve client acquisition and retention strategies. Effective budget planning for legal services enables firms to manage overhead costs and design sustainable attorney fee structures. Additionally, financial forecasting can help assess the impact of these investments on legal practice profitability and cash flow management. Embracing capital investment can position firms strategically in the competitive immigrant legal market, driving revenue generation and ensuring risk management is addressed effectively.

Loan Financing Calculator

Our innovative financial planning model incorporates a comprehensive loan amortization schedule tailored for immigration law firms. This dynamic tool details each installment, breaking down the principal and interest payments to ensure clarity in cash flow management. By utilizing pre-built algorithms, we empower firms to effectively manage overhead costs and forecast financials. This strategic approach not only enhances budgeting for legal services but also supports client acquisition and retention strategies, ultimately driving profitability in the competitive immigrant legal services market.

IMMIGRANT LEGAL ADVISING FIRM EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The payback period in an immigrant legal services firm is calculated by dividing client acquisition costs by the gross profit margin generated from new clients. This metric is essential for financial forecasting in immigration law practices, ensuring effective budgeting and cash flow management. By understanding this relationship, firms can refine pricing strategies for legal services and enhance profitability. Incorporating immigration case management software can further streamline operations, reducing overhead costs and improving client retention strategies. Ultimately, a comprehensive approach to financial planning and risk management will drive revenue generation and boost overall performance in the competitive immigrant legal market.

Cash Flow Forecast Excel

An operating cash flow chart is essential for understanding the financial health of your immigration law firm. By calculating cash generated solely from core business operations—excluding secondary revenue sources like interest or investments—you gain insights into your firm’s profitability. This financial forecasting tool aids in budget planning for legal services, revealing the connection between client acquisition costs and overhead expenses. Implementing effective legal billing strategies and pricing structures is crucial for optimizing cash flow management and enhancing overall financial planning. Utilize this chart to inform risk management and capital investment decisions, ensuring sustainable growth in the immigrant legal services market.

KPI Benchmarks

A robust startup financial model template, including a free benchmark tab, assesses key performance indicators vital for financial planning in immigration legal services. By highlighting average values and conducting comparative analyses, firms can strategically evaluate their performance. This approach not only aids in identifying effective revenue generation strategies but also enhances budgeting and cash flow management. Such insights are crucial for reducing client acquisition costs and improving legal practice profitability. Implementing these metrics fosters informed decision-making and risk management, ultimately guiding law firms toward sustainable growth and success.

P&L Statement Excel

At the heart of every successful immigrant legal services firm is a commitment to profitability. Implementing a robust income statement—both monthly and yearly—allows business owners to effectively analyze revenue alongside immigration law firm expenses. This financial forecasting tool is essential for understanding cash flow management and informs crucial decisions around attorney fee structures and client acquisition costs. By refining budget planning and implementing strategic client retention strategies, firms can optimize their revenue generation and ensure sustainable growth in the competitive immigrant legal market.

Pro Forma Balance Sheet Template Excel

A pro forma balance sheet is vital for any immigration law firm’s financial forecasting. By integrating profit and loss projections with cash flow forecasts, firms can achieve a balanced financial model. This template offers insights into key metrics, aiding in budget planning and cash flow management. Additionally, it helps investors evaluate leverage, productivity, and profitability ratios, crucial for assessing attorney fee structures and capital investments. Effective financial planning, alongside a robust immigration case management software, supports client acquisition and retention strategies, ensuring legal practice profitability and sustainable revenue generation in the immigrant legal market.

IMMIGRANT LEGAL ADVISING FIRM FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our streamlined startup valuation template for immigrant legal services equips you with essential data for investors and lenders. By calculating the weighted average cost of capital (WACC), you demonstrate the minimum expected return on investments. The free cash flow valuation reveals the cash available for stakeholders beyond operational needs, while discounted cash flow analysis assesses the present value of future revenue. This comprehensive approach enhances financial forecasting, aiding practices in budget planning and capital investment, ensuring your immigration law firm's profitability and sustainable growth. Unlock effective revenue generation strategies today!

Cap Table

A well-structured cap table serves as an invaluable tool for immigration law firms, enabling accurate calculations of investor share percentages and investment amounts. Its versatility enhances financial forecasting for legal practices, offering insights into budget planning and revenue generation strategies. By optimizing client acquisition costs and understanding legal billing strategies, firms can improve profitability. Additionally, implementing effective immigrant legal services and case management software allows for streamlined operations. This comprehensive approach not only supports cash flow management but also contributes to robust risk management and client retention strategies, positioning the firm for sustained success in the competitive legal market.

GROCERY STORE BUSINESS PLAN FORECAST TEMPLATE KEY FEATURES

Implementing a robust financial model enhances profitability and ensures sustainable growth for immigration law firms while minimizing overhead costs.

Effective financial forecasting empowers immigration law firms to mitigate cash flow shortfalls and enhance profitability through informed decision-making.

Implementing a robust legal aid revenue model enhances profitability while minimizing overhead costs and ensuring sustainable growth for immigration law firms.

Regular cash flow forecasting empowers immigration law firms to proactively manage finances, ensuring sustainable growth and improved profitability.

Effective financial planning for law firms enhances profitability, ensures sustainable cash flow, and optimizes client acquisition and retention strategies.

Easily adapt your immigrant legal services financial model to enhance profitability and streamline operations for sustainable growth.

Implementing effective financial forecasting for law firms enhances budgeting, improving profitability and client retention in immigrant legal services.

Utilizing a cash flow analysis template empowers immigration law firms to strategically plan for future financial stability and growth.

Implementing a robust financial model enhances profitability, optimizes client acquisition costs, and ensures sustainable growth for immigration law firms.

With our financial model for immigrant legal services, you'll attract investors and enhance your law firm's profitability effortlessly.

GROCERY STORE FINANCIAL MODEL ADVANTAGES

The financial model enhances profitability by streamlining client acquisition costs and optimizing pricing strategies for immigration legal services.

Implementing tailored financial forecasting in immigration law firms enhances profitability by optimizing expenses and client acquisition costs.

Discover new opportunities with our financial model, enhancing revenue generation and optimizing client acquisition costs for immigration law firms.

Utilizing an excel financial model for your immigrant legal advising firm enhances cash flow management and improves budgeting and profitability.

The three-way financial model enhances cash flow management, enabling law firms to identify payment issues and boost profitability.